Estimated Tax Payments 2026 Calendar Assessment Overview. Taxpayer should pay 15% of total tax liability if tax. This system is mandatory for taxpayers whose estimated tax liability is equal to or exceeds inr 10,000 during the financial year.

Taxpayer should pay 15% of total tax liability if tax. A complete guide to important due dates for income tax filing, gst returns, tds & tcs. Avoid penalties with timely filings.

Source: elkeyaugustina.pages.dev

Source: elkeyaugustina.pages.dev

Estimated Tax Payments 2024 Turbotax 2024 Mead Stesha Taxpayer should pay 15% of total tax liability if tax. Paying your taxes on time not only maximizes your savings but also helps you avoid penalties, interest charges, and a negative.

Source: www.youtube.com

Source: www.youtube.com

IRS Form 1040ES walkthrough (Estimated Tax Voucher) YouTube Paying your taxes on time not only maximizes your savings but also helps you avoid penalties, interest charges, and a negative. This system is mandatory for taxpayers whose estimated tax liability is equal to or exceeds inr 10,000 during the financial year.

Source: ijacobrussell.pages.dev

Source: ijacobrussell.pages.dev

Federal Estimated Tax Payment Due Dates 2025 I Jacob Russell Taxpayer should pay 15% of total tax liability if tax. This system is mandatory for taxpayers whose estimated tax liability is equal to or exceeds inr 10,000 during the financial year.

Source: johndhylton.z13.web.core.windows.net

Source: johndhylton.z13.web.core.windows.net

20252026 Tax Brackets A Comprehensive Overview John D. Hylton Taxpayer should pay 15% of total tax liability if tax. A complete guide to important due dates for income tax filing, gst returns, tds & tcs.

Source: schwartzregan.pages.dev

Source: schwartzregan.pages.dev

Estimated Tax Payments 2025 Calendar Regan Schwartz Avoid penalties with timely filings. This system is mandatory for taxpayers whose estimated tax liability is equal to or exceeds inr 10,000 during the financial year.

Source: florencemlowem.pages.dev

Source: florencemlowem.pages.dev

Why Do I Have Estimated Tax Payments For 2025 Florence M Lowe Taxpayer should pay 15% of total tax liability if tax. A complete guide to important due dates for income tax filing, gst returns, tds & tcs.

Source: ryancspooner.pages.dev

Source: ryancspooner.pages.dev

Estimated Tax Payments 2025 Calendar Ryan Spooner A complete guide to important due dates for income tax filing, gst returns, tds & tcs. This system is mandatory for taxpayers whose estimated tax liability is equal to or exceeds inr 10,000 during the financial year.

Source: nancylrogersl.pages.dev

Source: nancylrogersl.pages.dev

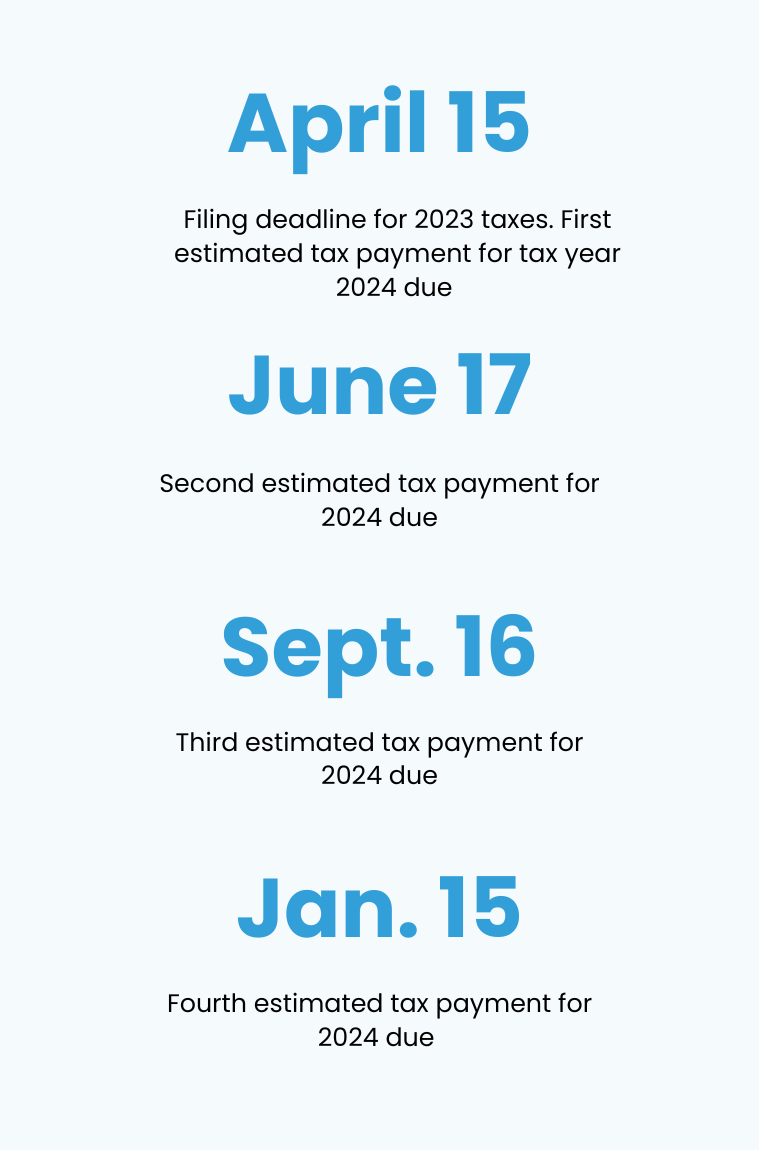

Tax Return 2025 Estimate Calendar Nancy L. Rogers Paying your taxes on time not only maximizes your savings but also helps you avoid penalties, interest charges, and a negative. A complete guide to important due dates for income tax filing, gst returns, tds & tcs.

Source: halslewiss.pages.dev

Source: halslewiss.pages.dev

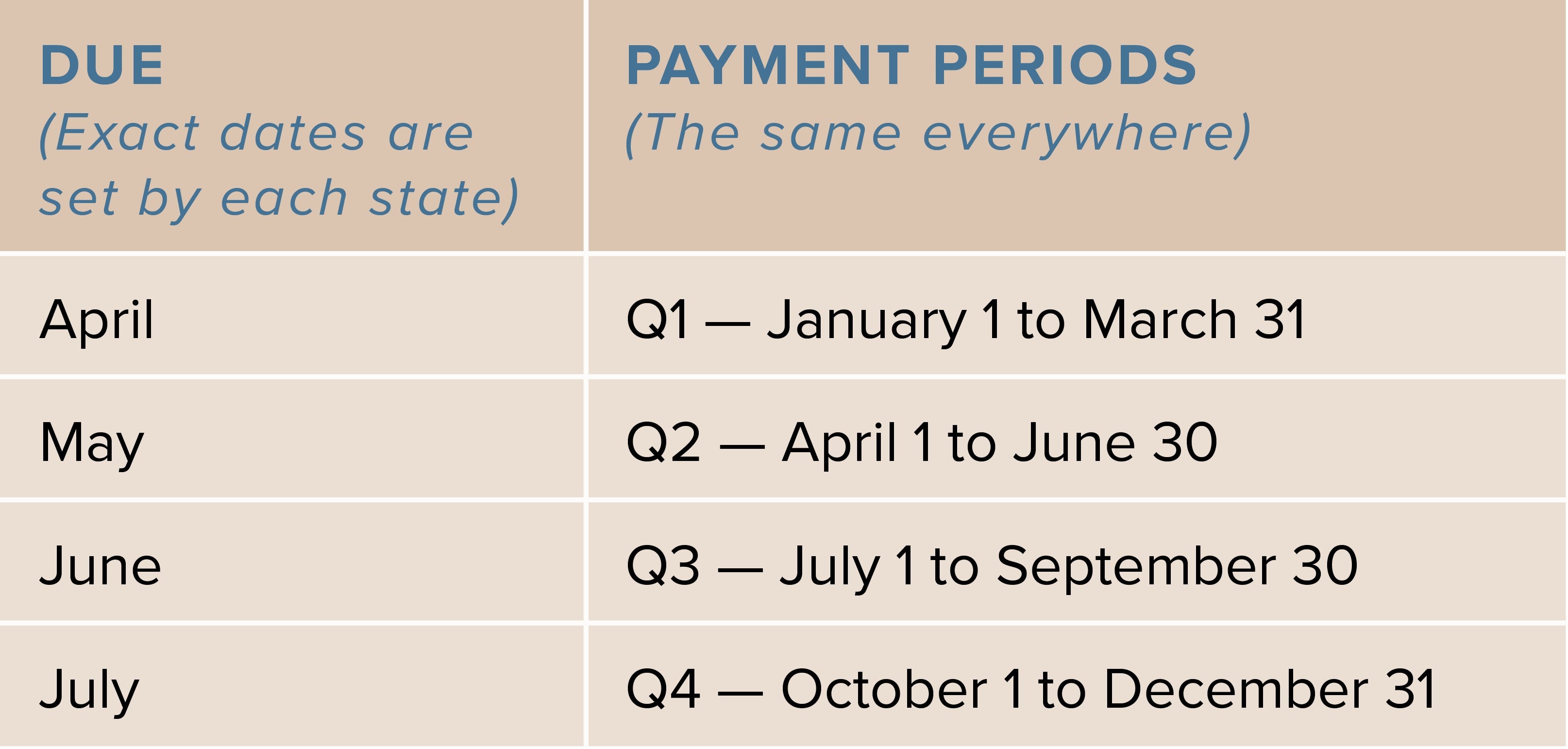

When Are Quarterly Estimated Taxes Due 2025 In Mumbai Hal S. Lewis A complete guide to important due dates for income tax filing, gst returns, tds & tcs. This system is mandatory for taxpayers whose estimated tax liability is equal to or exceeds inr 10,000 during the financial year.

Source: teresaagarciaa.pages.dev

Source: teresaagarciaa.pages.dev

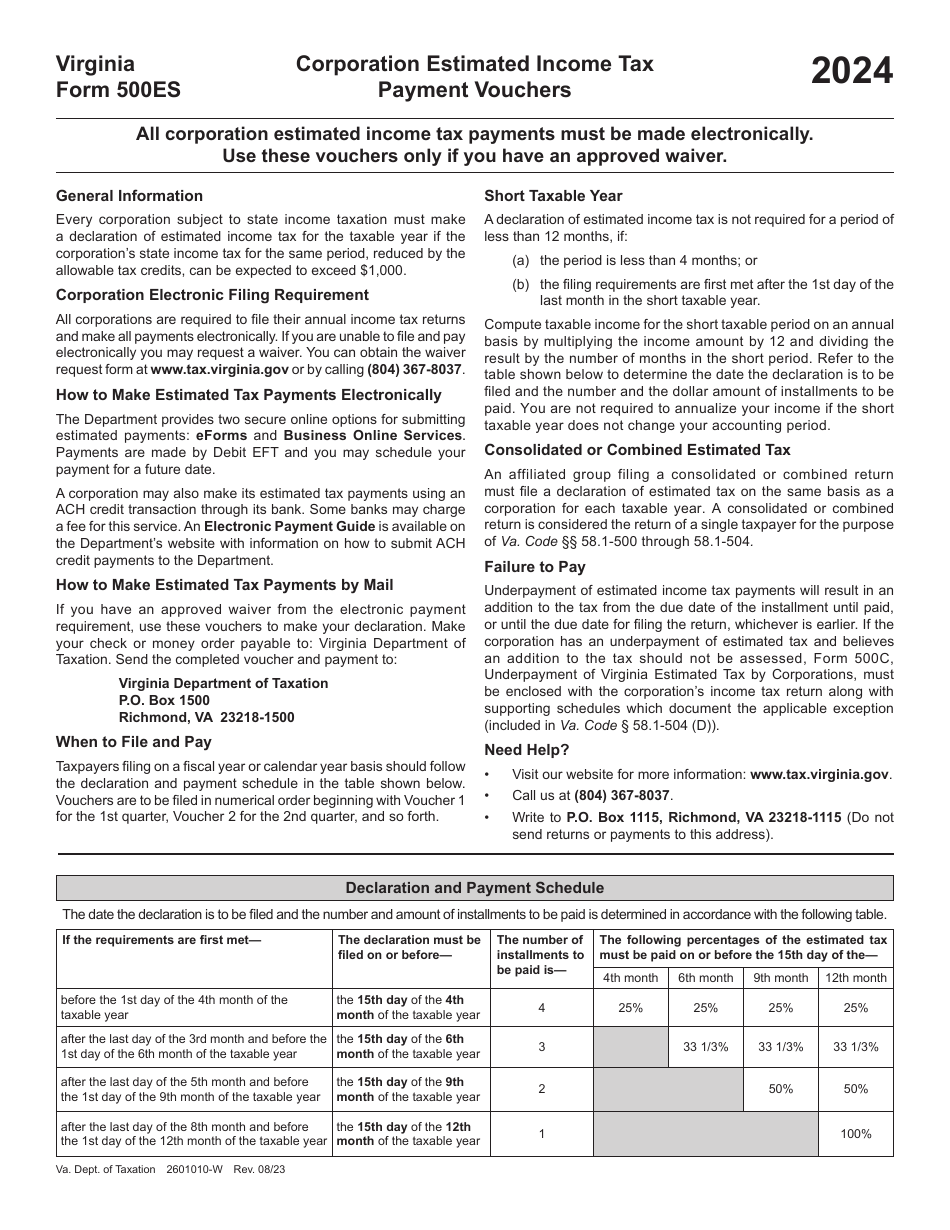

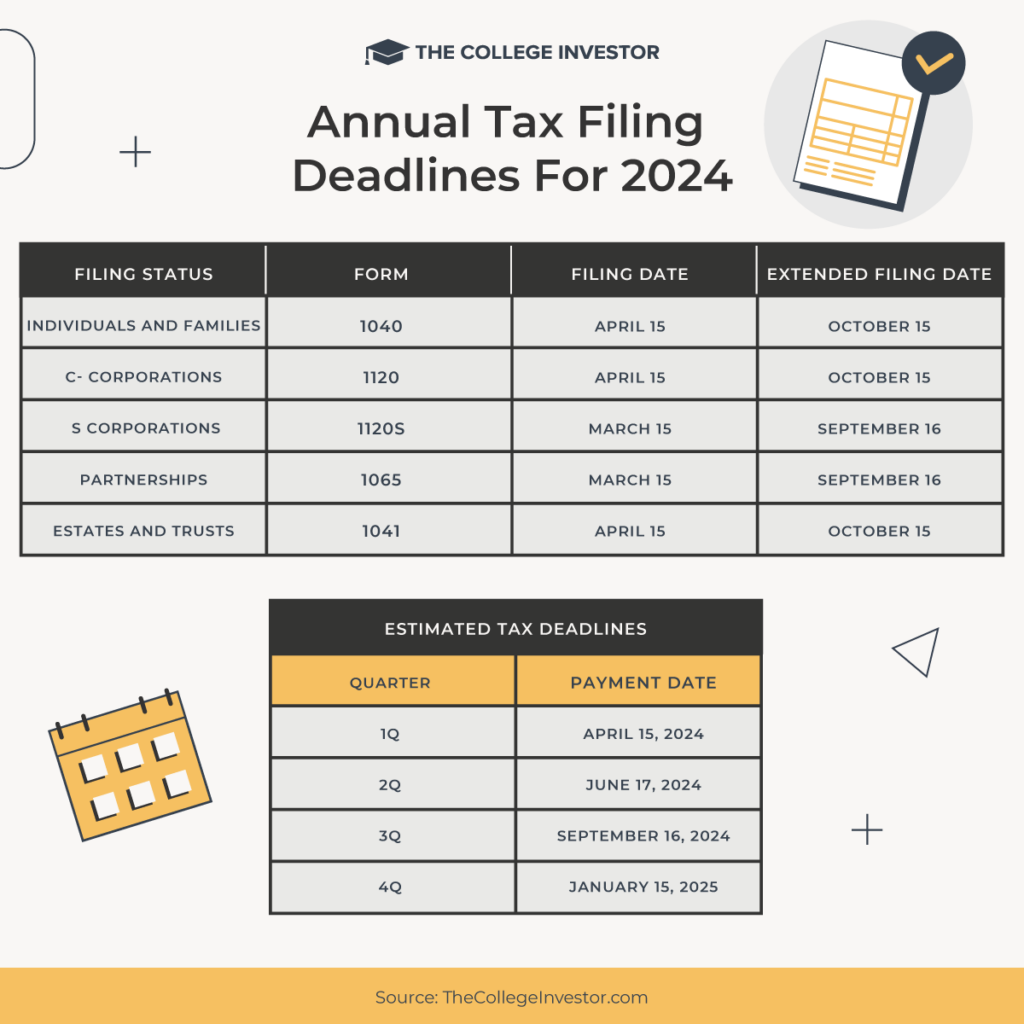

Corporate Tax Filing Deadline 2025 Calendar Teresa A Garcia A complete guide to important due dates for income tax filing, gst returns, tds & tcs. Avoid penalties with timely filings.

Source: bookkeeperlive.com

Source: bookkeeperlive.com

What is IRS Form 1040ES? Understanding Your Estimated Taxes Paying your taxes on time not only maximizes your savings but also helps you avoid penalties, interest charges, and a negative. Avoid penalties with timely filings.

Source: kayslemieuxs.pages.dev

Source: kayslemieuxs.pages.dev

2025 Estimated Tax Calendar Kay S. Lemieux Paying your taxes on time not only maximizes your savings but also helps you avoid penalties, interest charges, and a negative. A complete guide to important due dates for income tax filing, gst returns, tds & tcs.